Today’s edition of The Daily covers everything from hardware wallets to fake volume on cryptocurrency exchanges. But to kick-start proceedings, we’ve got the first report on a survey in which a surprising proportion of freelancers express an interest in being paid in cryptocurrency.

Also read:Â Swiss Crypto Valley Association Leadership Steps Down After Governance Review

US Freelancers Express Interest in Crypto Payments

P2P platform Humans.net has commissioned a survey into the payment preferences of American freelancers. It quizzed 1,100 U.S. citizens to determine their amenability to being paid in bitcoin or other cryptocurrencies, with 18 percent expressing a clear preference for digital currency payments over fiat currency. Among those questioned were self-employed professionals such as tutors, designers and developers.

Given that the respondents were drawn from across the gig economy and were not prescreened for cryptocurrency interest, the 18 percent statistic can be taken as evidence of growing interest in bitcoin. An additional 11 percent of those surveyed stated that they would like to receive partial payments in cryptocurrency, making a total of 29 percent of freelancers who would be happy to receive crypto.

Ellipal and Ledger Wallets Get an Upgrade

The software that powers cryptocurrency hardware wallets is regularly updated to incorporate new features and coin additions. Ellipal, whose wallet we reviewed a few weeks back, has just had its firmware refreshed. “The Cold Wallet 2.0,†which ships from Hong Kong, now supports XRP, DGB, LTC, DASH, ETC, USDT and CMT, in addition to existing cryptos BTC, BCH and ETH. The accompanying Ellipal smartphone app has also been upgraded, with an improved UI and a new digital assets overview page. Meanwhile, Ledger has updated its Nano S wallet to support monero (XMR).

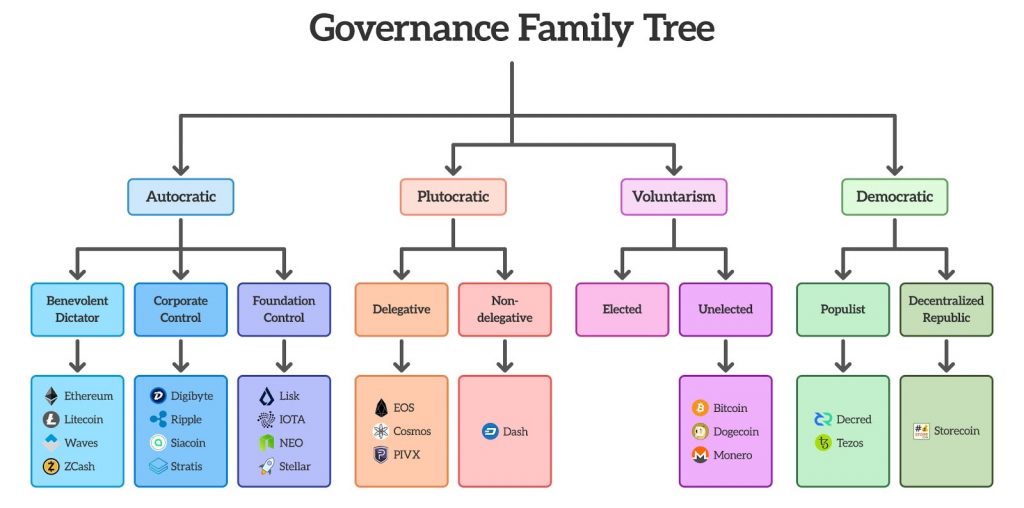

Storecoin Launches Governance Peer Review

It’s not uncommon for cryptocurrency projects to seek peer review of their technical papers. Zero-fee payment protocol Storecoin has narrowed in on a highly specific facet of its forthcoming blockchain however — governance. In addition to establishing a Governance Peer Review & Working Group, the project is soliciting community feedback on the trade-offs it has proposed in order to settle upon a workable system of governance.

“We believe that the only governance model that can function at global enterprise scale without returning to centralization or descending into the volatility of mob rule is a checks-and-balances based system,†concludes its public peer review document.

Coinbit and GDAC Accused of Manipulating Volume

Coinbit and GDAC, two South Korean exchanges that launched during the summer, have joined the growing list of Asian platforms that Crypto Exchange Ranks (CER) accuses of fake volume. Inflating trading figures is a way that some exchanges game the system, placing them higher in Coinmarketcap’s top 100 exchanges by reported volume. Coinbit currently places fourth, with around $ 600 million of cryptocurrency supposedly traded in the past 24 hours, while GDAC occupies the 53rd spot.

“Since GDAC’s trade fees are 0 percent the exchange redistributes its tokens ‘based on contribution for buy orders’ and calls it a ‘Purchase Contribution Air Drop,’ but the principle is the same as trans-fee mining,†explains CER. It also notes that in mid-November, Coinbit claimed the top spot on Coinmarketcap by reported volume, placing it ahead of Binance and Bitmex. Transaction fee mining exchanges remain highly controversial, with CER having previously taken platforms like Bitforex and Fcoin to task for similar practices. When Coinmarketcap’s exchanges are ranked by adjusted volume rather than reported volume, it’s no surprise that Coinbit and GDAC fall out of the top 100.

“Since GDAC’s trade fees are 0 percent the exchange redistributes its tokens ‘based on contribution for buy orders’ and calls it a ‘Purchase Contribution Air Drop,’ but the principle is the same as trans-fee mining,†explains CER. It also notes that in mid-November, Coinbit claimed the top spot on Coinmarketcap by reported volume, placing it ahead of Binance and Bitmex. Transaction fee mining exchanges remain highly controversial, with CER having previously taken platforms like Bitforex and Fcoin to task for similar practices. When Coinmarketcap’s exchanges are ranked by adjusted volume rather than reported volume, it’s no surprise that Coinbit and GDAC fall out of the top 100.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

Bitcoin News

Leave a Reply