The approval of a spot ethereum exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC) could be the crypto asset’s “strongest narrative,” according to a Kaiko Research analysis. The Kaiko Research team believes that ethereum’s rally post-bitcoin ETF approvals show that investors are betting on the regulator’s approval of ether-based ETFs.

ETH Outperforms ETH Beta Tokens

According to an analysis carried out by Kaiko Research, the potential approval of a spot-based ethereum (ETH) exchange-traded fund (ETF) is likely to be the crypto asset’s current “strongest narrative.” To support this assertion, the analysis points to bitcoin’s performance before the SEC approved a spot bitcoin ETF.

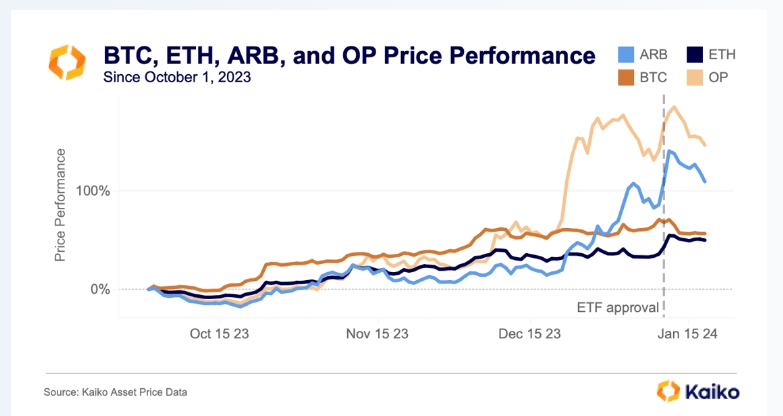

As per Kaiko data, in the 365 days before the ETF approval, bitcoin’s return of 100% easily outpaced ETH’s 60%. Indeed, in the weeks and days leading up to the approvals, BTC surged past $ 48,000, and some predicted the crypto asset’s USD value to go beyond $ 50,000 after the spot ETFs approvals.

However, since the SEC’s approval of 11 spot bitcoin ETFs, the price of BTC has trended downwards, while that of ETH has rallied. The Kaiko team implied that this may indicate investors are “building on the hype that ETH could be next in line.” Another metric highlighted by the Kaiko Research analysis relates to investors’ preference for tokens related to ETH but with higher volatility also known as ETH beta.

According to the analysis, interest in ETH beta post-approval has faded, while that of ETH “has outperformed by falling the least.” During the second week of January, ETH spot volume on centralized exchanges touched its highest level since the FTX collapse. In fact, in that week, ETH notched its three highest spot volume days since the start of 2023.

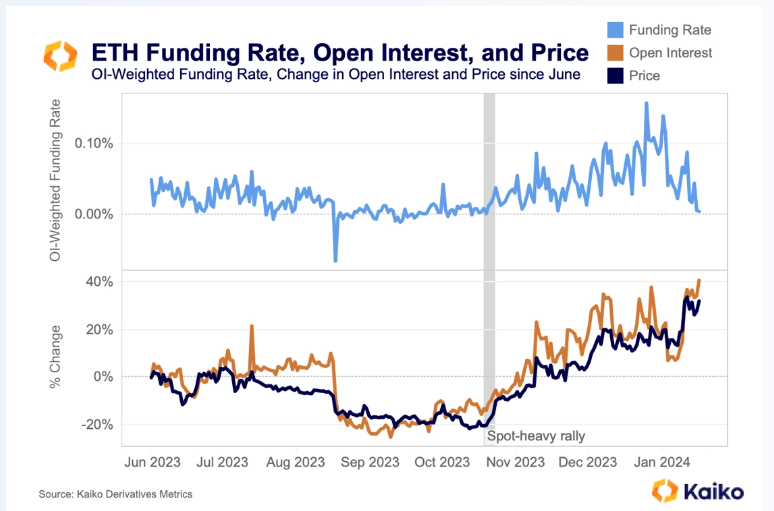

Meanwhile, Kaiko’s derivatives data show that ETH’s recent performances were primarily fueled by spot volumes and not perpetual futures. The report added:

September and October marked a low point in futures markets, with aggregated open interest (in USD) falling more than 20% from its summer levels. At this time, there was little price movement and funding rates were neutral.

In their conclusion, the Kaiko team stated that while the ETF narrative is more likely to rekindle interest in ether, still if this were to fail, other narratives such as new layer twos (L2s) or the success of Eigenn Layer and restaking” could be the catalysts for the crypto asset’s next rally.

What are your thoughts on this story? Let us know what you think in the comments section below.

Bitcoin News

Leave a Reply