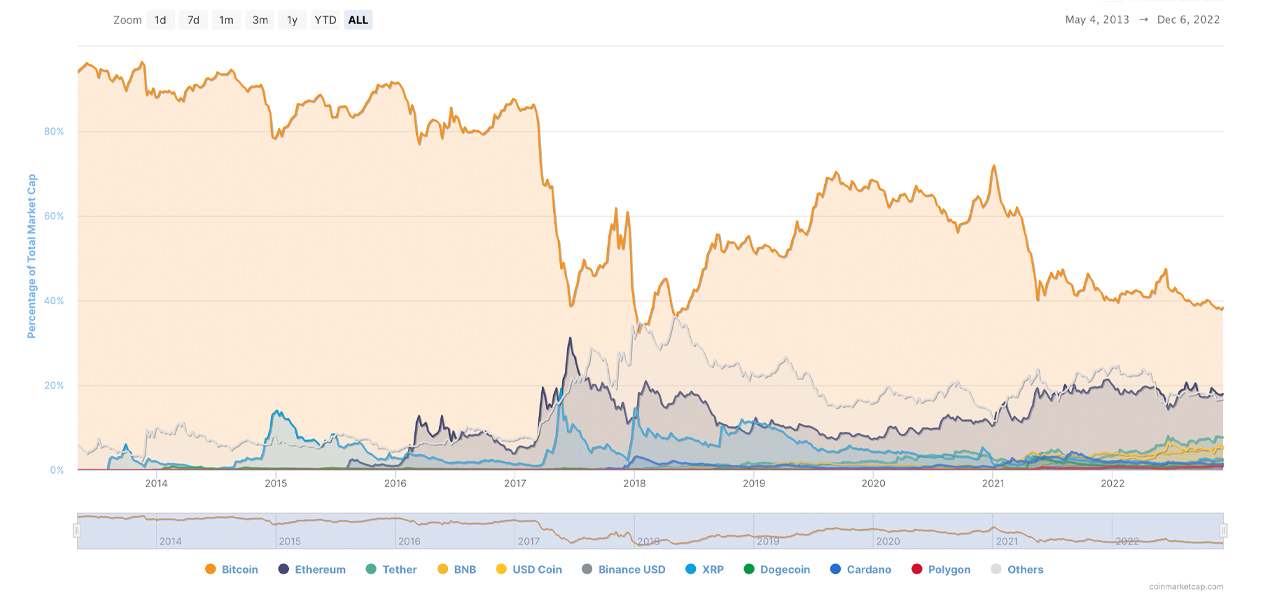

Over the last 100 days or roughly three months, bitcoin’s market dominance among 21,958 different crypto assets worth roughly $ 850 billion has been under 40%. Bitcoin dominance has been under 40% since Aug. 27, 2022, with a brief instance of rising above the 40% range 52 days ago, on Oct. 15.

Bitcoin’s Market Superiority Lost 41% in 35 Months

Bitcoin’s market capitalization has been above the $ 325 billion region since Nov. 29, 2022. At the time of writing, bitcoin’s (BTC) overall market valuation is around $ 328 billion, which represents around 38.3% of the crypto economy’s entire $ 856,947,917,107 market cap.

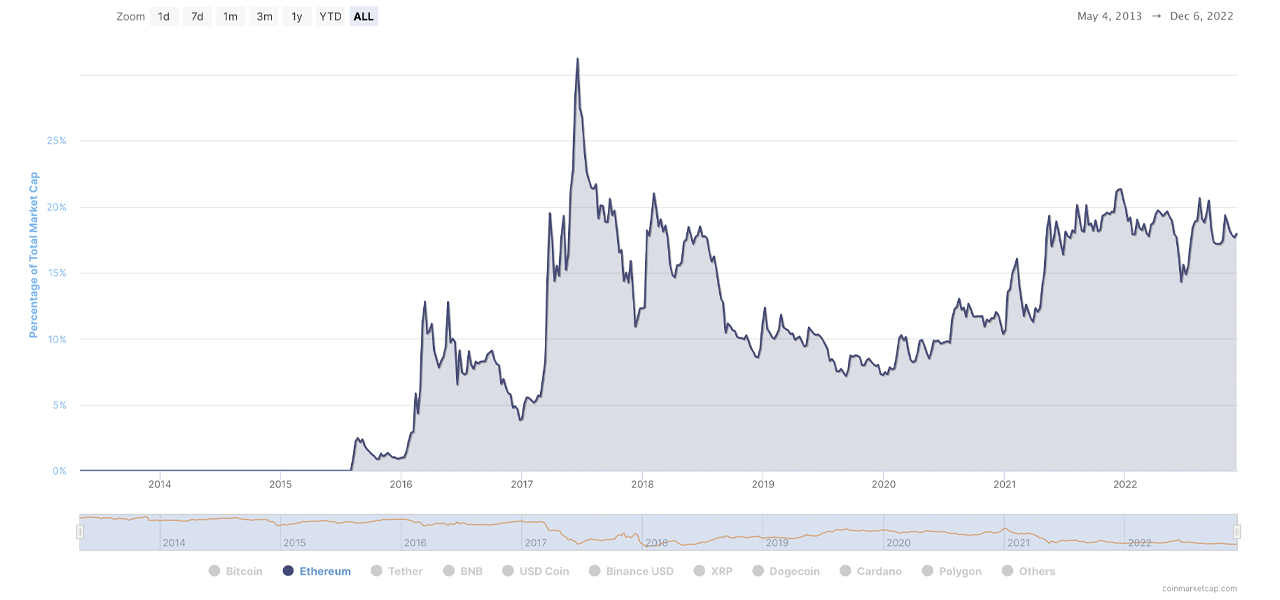

The second leading crypto asset, ethereum (ETH), on the other hand, has a market cap today of around $ 155.38 billion or 18.1% of the aggregate $ 856 billion. In the early days, BTC’s market supremacy was above the 90% region from when it first gained value in 2010, all the way up until the second week of Nov. 2014.

Crypto market dominance, among the thousands of digital asset market capitalizations, refers to the relative size of the coin’s capitalization compared to the overall market capitalization of the entire crypto economy. After mid-Nov. 2014, BTC’s market dominance slid below the 90% region but remained above the 80% range all the way until the first week of March 2017.

Essentially, during those early days, BTC’s market superiority was 90% for 61 months and after Nov. 2014, it was above 80% for 33 months. However, there were a brief few instances in Jan. 2015, March 2016, May 2016, and Sept. 2016, that saw BTC’s market dominance drop below the 80% region.

Bitcoin dominance has been lower than 80% for 68 months to date, and it’s been struggling to hold the 40% range in more recent times. On May 15, 2021, and up until Aug. 27, 2022, BTC’s market supremacy in terms of capitalization had been above the 40% range which was around 15 months.

Ethereum, Tether, and Dogecoin Market Dominance Levels Rise

Today, it’s been more than a solid three months of BTC dominance below the 40% range and dominance has not been this low since May 2018. From a logarithmic perspective, ethereum’s (ETH) market dominance, among all the other digital assets, has shown a significant rise since Jan. 2020.

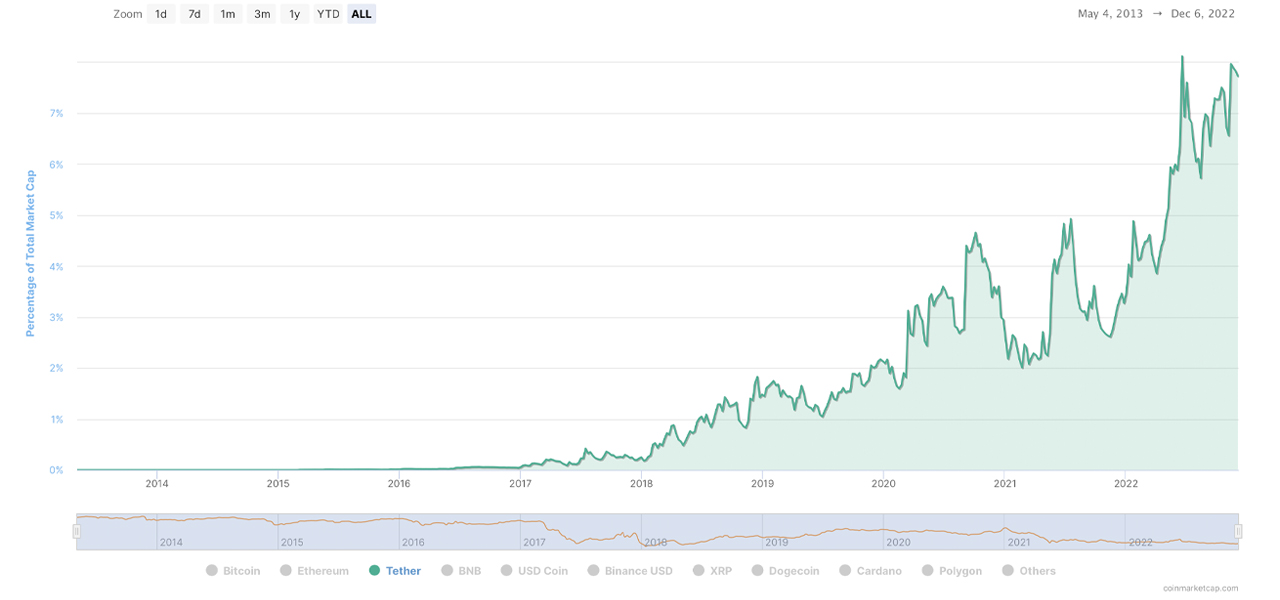

ETH dominance increased 130.86% since Jan. 2020, while BTC dominance gradually slid 41.96% in that time frame. From January 2020 until today or roughly 35 months, tether’s (USDT) market dominance jumped 285%, in comparison to the aggregate value of more than 20,000 listed crypto assets.

BNB saw its market dominance grow by 440% over the last 35 months and usd coin’s (USDC) dominance jumped by 2,500%. Like bitcoin (BTC), xrp’s (XRP) market supremacy has dropped during the last 35 months, sliding 47% since January 2020.

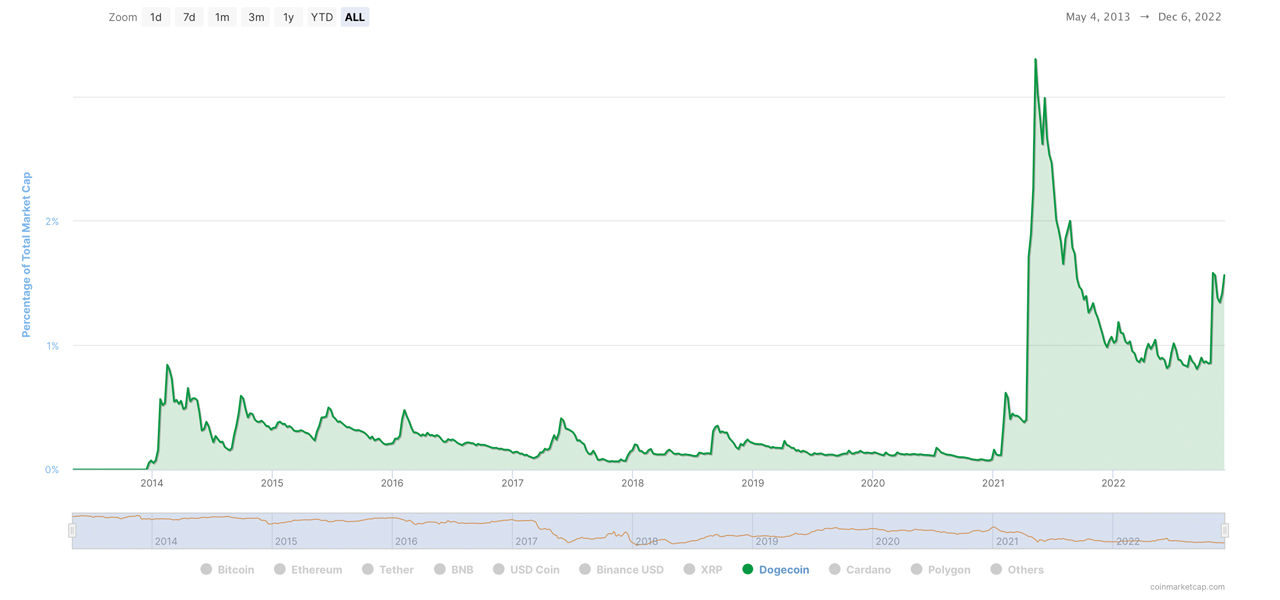

Out of the top ten digital assets in terms of market valuations, BTC’s and XRP’s dominance levels have seen the worst declines. The meme token dogecoin’s (DOGE) dominance level, on the other hand, jumped 1,100% higher during the past 35 months.

There’s a great deal of people who don’t put much value into market capitalization and dominance data when it comes to digital currencies. For instance, a bitcoin maximalist would say that BTC’s market cap is all that matters, and others may say that a meme coin like DOGE shouldn’t be compared to blockchains that were not meant to be a joke.

However, many crypto supporters do believe market dominance levels offer meaningful data. Bitcoin and ethereum, for instance, can be viewed against their competitors as having high market superiority levels, which can have a significant influence on the market. More often than not, when BTC’s and ETH’s prices go up or down, alternative crypto assets follow the dominant crypto’s market patterns.

What do you think about bitcoin’s dominance levels among the thousands of market capitalizations? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

Bitcoin News

Leave a Reply