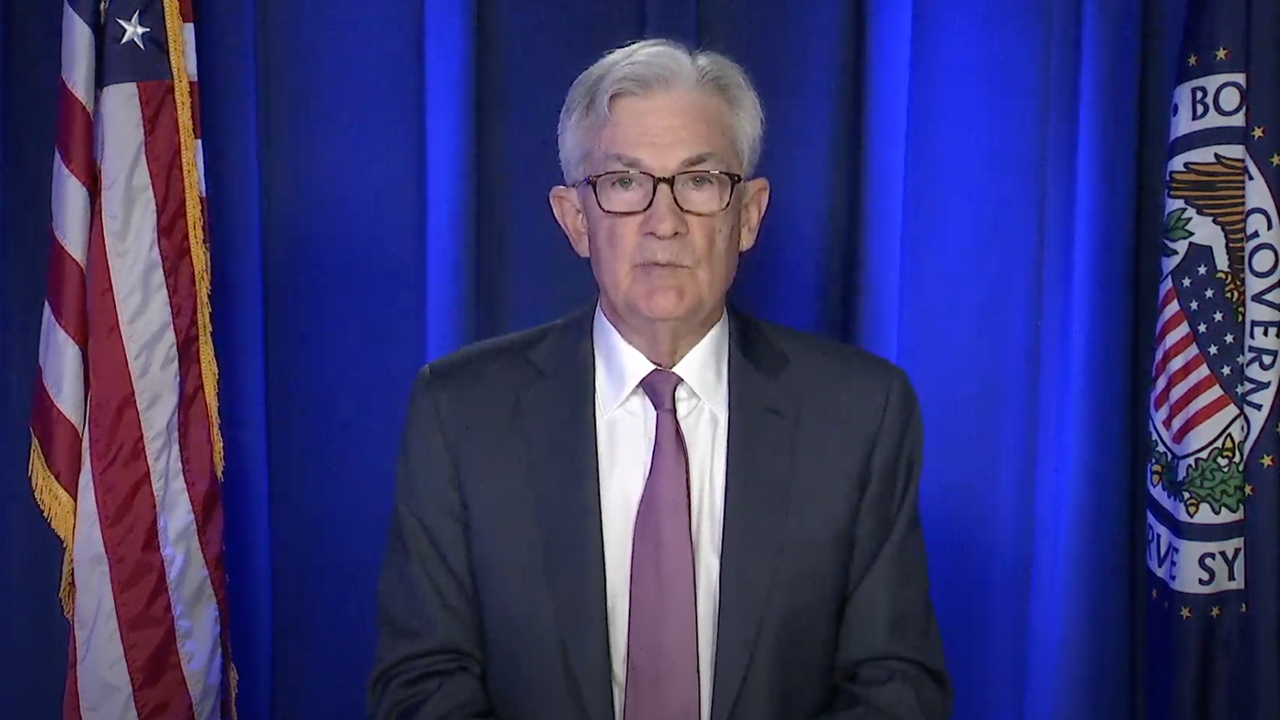

On Wednesday, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell held a press conference concerning the American economy, the central bank’s plans to address inflation, and the ongoing Russia-Ukraine war. Powell announced that the FOMC decided to increase the benchmark bank rate by a quarter percentage and further noted the Fed anticipates “ongoing increases…will be appropriate.â€

Federal Reserve Increases Benchmark Bank Rate

For the first time since the onset of the Covid-19 pandemic, the Federal Reserve announced that it increased the benchmark interest rate from near zero to 0.25% in order to target 0.25% and 0.50%.

Fed chair Jerome Powell revealed the rate hike on Wednesday after mentioning the Russia-Ukraine ongoing conflict and he stressed that “the implications for the U.S. economy are highly uncertain.â€

However, after mentioning that the U.S. economy, particularly the jobs sector was showing strength, Powell quickly explained that the FOMC raised the benchmark bank rate by a quarter percentage and highlighted that “ongoing increases…will be appropriate.â€

Powell also discussed tapering back the Fed’s purchase program but noted that details on that particular arrangement would be disclosed at a later meeting. The last time the Fed raised the benchmark bank rate was in December 2018 well before the Covid-19 pandemic.

The Fed’s post-meeting statement also discussed reducing the U.S. central bank’s balance sheet at the next FOMC meeting. “The committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting,†the post-meeting statement details.

In addition to the quarter percent increase, the FOMC expects an additional six rate hikes at each and every FOMC meeting. Moreover, the central bank also expects to increase rates an additional three times next year.

“The committee is determined to take the measures necessary to restore price stability. The U.S. economy is very strong and well-positioned to handle tighter monetary policy,†Fed chair Jerome Powell detailed during his press conference statements.

Federal Reserve Says US Inflation Remains Elevated

After the rate hike, the economist and gold bug Peter Schiff tweeted about the Fed’s move. “The only reason the Fed hiked rates is inflation,†Schiff said. “Prior to admitting inflation wasn’t transitory, the Fed wasn’t planning any rate hikes in 2022. Given current geopolitical risks and weakness in the economy and financial markets, the Fed just ran out of excuses to stay at zero.â€

The U.S. central bank did in fact admit to inflation remaining high in post-meeting statements. “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures,†the FOMC rate hike announcement explains.

Meanwhile, the popular U.S. indexes Nasdaq, Dow Jones Industrial Average, NYSE, and S&P 500 all remained in green after the FOMC rate hike announcement. Crypto economy markets further remained consolidated, after a brief jump during the early morning trading sessions on Wednesday (ET).

The crypto economy is still up 1.2% in the last 24 hours, following the FOMC statements. The price of one ounce of .999 fine gold is down 0.17% during the last 24 hours. At press time, one ounce of gold is exchanging hands for $ 1,914 per ounce, down 7.08% since the asset’s recent $ 2,060 all-time high.

What do you think about the Federal Reserve raising the benchmark interest rate for the first time since 2018? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

Bitcoin News

Leave a Reply