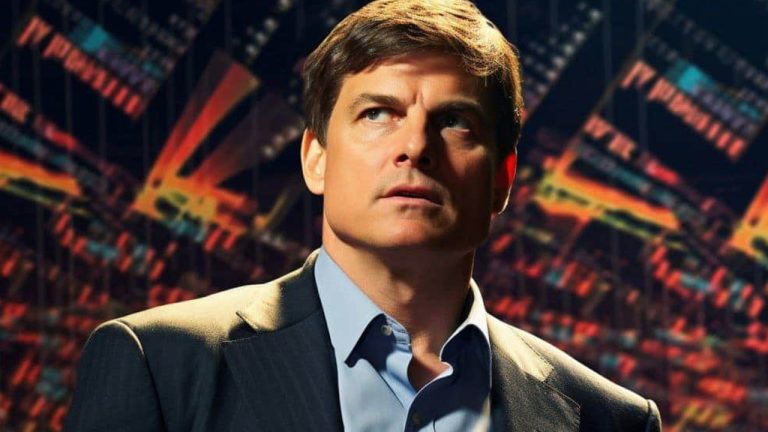

Michael Burry, famously known for his bold ‘Big Short’ wager against subprime mortgages in the early 2000s, has recently offloaded several substantial bearish positions following unsuccessful outcomes. As the founder of Scion Asset Management, Burry dissolved his put options on major indices and semiconductor stocks during the third quarter, as revealed by regulatory documents. These divestments mark a significant shift, unwinding bets that had reached a notional value surpassing $ 1.6 billion earlier this year.

Burry’s Bearish Bets Get Shuffled According to Scion’s 13F Filings

Gaining notoriety for his strategic bets against the surging housing market and intricate mortgage securities that resulted in enormous gains during the market collapse, Michael Burry’s latest endeavors to capitalize on market downturns have predominantly misfired. Initiated in the second quarter, his renewed short positions targeting the S&P 500, and the Nasdaq 100 through puts, saw Burry compelled to abandon these trades in the third quarter amidst an ongoing market rally.

During this period, Burry entirely withdrew his puts on the S&P 500 and Nasdaq 100 exchange-traded funds (ETFs), positions that constituted nearly $ 1.6 billion in total notional exposure. With the major indices remaining robust, surpassing levels from late June when Burry placed these bets, it’s probable that these trades either resulted in losses or became worthless.

Contrary to some beliefs, Burry’s wager did not equate to a $ 1.6 billion loss, as per an analysis by X account holder Saaketh Koka. Koka clarified that the substantial notional value of Burry’s index bets doesn’t mirror the actual amount risked. The leverage inherent in options contracts typically results in significantly higher notional exposure compared to the capital invested.

The combined $ 1.6 billion notional value of Burry’s S&P 500 and Nasdaq 100 puts reflects the total value of the indices he shorted, not the actual premium paid. While the notional size seems colossal at $ 1.6 billion, Koka emphasized that the actual cost and risk were likely under $ 10 million, considering standard option pricing.

Additionally, the ‘Big Short’ investor also liquidated a $ 47 million bearish position against the semiconductor sector via puts on the SOXX ETF, a bet that consistently depreciated as chip stocks made a comeback this year. Furthermore, Burry readjusted most of his equity portfolio in the last quarter, exiting 25 holdings including previous primary investments such as Expedia, Charter Communications, and Generac Holdings.

In contrast, he augmented a few existing, smaller stakes, notably in Nexstar Media Group and Star Bulk Carriers. Chinese technological giants Alibaba and JD.com also re-emerged in his portfolio after a brief hiatus. These alterations followed a challenging second quarter for Burry’s investments, where he offloaded most of his first-quarter stakes, including earlier long positions in Alibaba, JD.com, and Zoom Video.

Rising to prominence with his exceptionally lucrative short positions on the housing bubble and mortgage securities, Burry’s recent failures underscore the challenges faced by even renowned investors in consistently predicting market dynamics and timing macroeconomic shifts.

Known as “Cassandra B.C.†on social media platform X, Burry predicted a protracted, multi-year recession for the U.S. economy in December 2022. However, by April, he revisited his stance on his shorts, taking to social media to admit “I was wrong to say sell†and extended his congratulations to the “BTFD generation.â€

What do you think about the ‘Big Short’ investor Michael Burry’s latest moves? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin News

Leave a Reply